Germany offers one of the most generous work permissions for international students in the world. However, the rules are strict. If you work one hour too many, you risk losing your visa.

Whether you want to deliver food, work in a library, or land a corporate internship, here is the honest reality of working part-time in Germany in 2026.

1. The “140 Full Days” Rule (Updated)

Forget the old “120 days” rule you might see on outdated blogs. Since the legislative changes in March 2024, students from non-EU countries (like India) are allowed to work:

140 Full Days per year, OR

280 Half Days per year.

What counts as a “Half Day”? Any shift up to 4 hours. If you work 4.5 hours, it counts as a full day.

The “20-Hour” Cap: During the semester (lecture period), you are generally limited to 20 hours per week. Why? If you work more, the government assumes you are no longer a “full-time student,” and you will have to pay expensive social security contributions (unemployment & nursing care insurance).

2. Types of Jobs: Mini-Job vs. Werkstudent

Understanding this difference will save you hundreds of Euros in taxes.

A. The “Mini-Job” (Tax-Free)

This is the most popular option for new students.

Earnings Limit: Maximum €603 per month (2026 limit).

Taxes: You pay €0 in taxes. You also don’t pay for health or unemployment insurance.

Pension: You pay a tiny portion (3.6%) into the pension fund, but you can even opt out of this.

Best for: Delivery riders, waiters, cashiers, babysitters.

B. The “Werkstudent” (Working Student)

This is for students who want career experience.

Earnings: You can earn more than €603.

Taxes: You still pay very little tax (usually none if you earn under ~€11,000/year), but you must pay pension insurance (9.3%).

Benefit: You are still exempt from paying health insurance (KV) and nursing insurance (PV) as long as you work under 20 hours/week.

New for 2026: The minimum wage in Germany has risen to €13.90 per hour. This means the tax-free “Mini-job” limit has also increased to €603 per month.

3. How Much Can You Actually Earn?

Let’s do the math with the 2026 Minimum Wage (€13.90/hr).

If you work the maximum allowed during the semester (20 hours/week):

Weekly: 20 hours x €13.90 = €278

Monthly: €278 x 4.3 weeks = ~€1,195

The Reality Check: While you can earn €1,195, most students find that working 20 hours a week while studying for tough German exams is very difficult. A realistic target is 10-12 hours a week, earning you around €600 – €700 per month. This is enough to cover rent and food in most cities!

4. Taxes: The “Steuer-ID”

To work, you need a Tax ID (Steueridentifikationsnummer).

You get this automatically by mail 2-3 weeks after you do your Anmeldung (City Registration).

Important: Do not lose this number. You need it for every job you will ever have in Germany.

Related Articles

Study Abroad 2026: The Ultimate Visa Comparison (UK vs. Germany vs. Canada vs. Australia)

Deciding where to study is not just about the university; it's about the Visa Policy. You don't want to pay tuition only to get a rejection letter 3 months later. Here is the 2026 expert breakdown of the top destinations. 1. Canada: The "Red Zone" (High Risk) Once the...

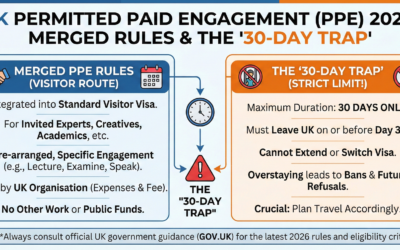

UK Permitted Paid Engagement (PPE) 2026: Merged Rules & The “30-Day Trap”

Usually, you cannot work on a Tourist/Visitor visa. That is the golden rule of immigration. But there is one exception: The Permitted Paid Engagement (PPE). This route is a lifeline for professionals—like professors, lawyers, and artists—who are invited to the UK for...

Standard Visitor Visa for the UK: Tourism and Family Visits

Applying for a UK visa from Punjab is trickier than applying for Schengen. The UK Home Office does not interview you; they judge you purely on your Bank Statements. If your financial paper trail isn't perfect, you get a refusal letter stating: "I am not satisfied you...

Stay Up to Date With The Latest News & Updates

Contact Us Today!

Start your study abroad journey today! Special descounts for student

Join Our Newsletter

Stay up to date with the latest news in the immigration

Follow Us

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque